Trading Places is a film that offers some insight into some of the problematic methods of rewarding employees through variable pay. Doing it with the right intentions and choosing the best method for your organisation can result in huge success. However, it’s important to understand the challenges surrounding certain approaches.

Amid the hilarity of Trading Places are uncomfortable reminders of the extreme inequality and social/racial divides that exist and how quickly fortunes can change. Sadly, the vast divide between rich and poor has only become more relevant since the 1980s when the film was released.

In one scene, the protagonists Mortimer and Randolph are reading when the butler, Ezra, enters the room carrying two glasses of milk. At this moment, Randolph remembers Ezra’s Christmas bonus and hands him a measly five dollars. Ezra sarcastically suggests that he will use the money to go to the movies—alone. ‘Half of it is from me,’ Mortimer reminds him, as Ezra swears under his breath and walks away.

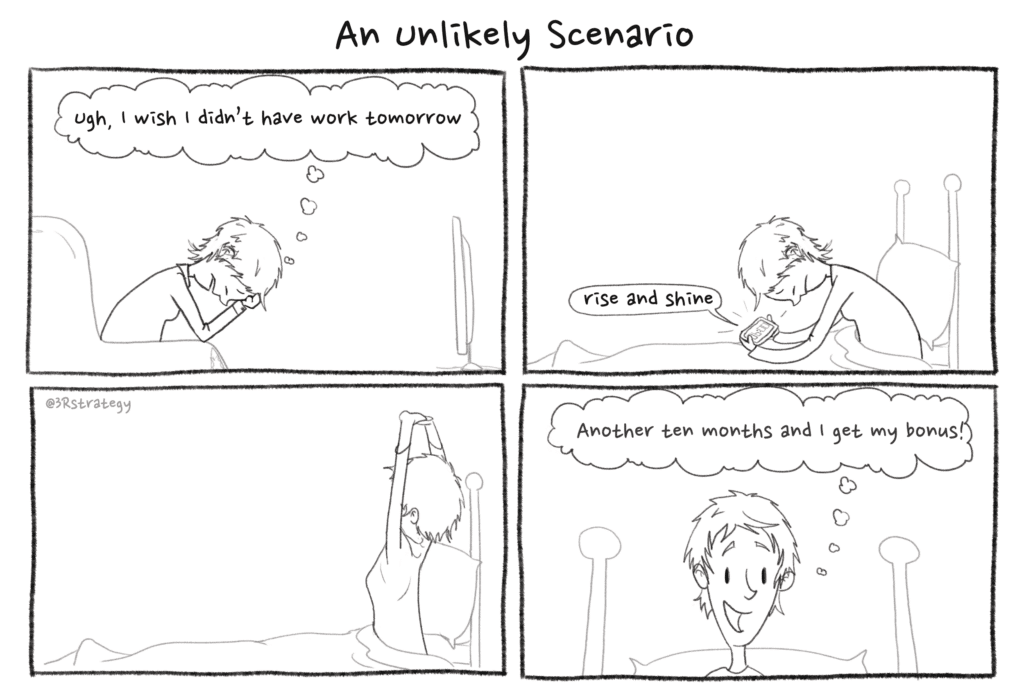

Not all bonuses are motivating. If no thought or care goes into a bonus payment, it can do more harm than good. Let’s take a look at how we should approach these payments.

What is Variable Pay?

The simplest definition is pay for results, i.e. it is not guaranteed. These payments may be based on individual, team or organisational results. They may be financial, operational or even behavioural.

The best variable pay solutions need to emphasise two things:

- Specific goals and measures

When you’re looking at targets, it is useful to review them on a regular basis. You don’t need to use a formulaic approach or punish people for missing targets, but regular reviews do help your people plan and improve their productivity.

- Simplicity and transparency

The objective of variable pay is typically to drive performance or behaviours. For this to work, people must have a sound understanding of the variable pay plan. It is also important to communicate clearly in order to set employee expectations. Otherwise, people will see variable pay as an additional element of their reward package and come to expect it every year.

6 Types of Variable Pay

In many organisations, people tend to refer to all variable pay as a bonus, but there are subtle differences that are important to understand. To design and communicate a variable pay scheme, we need to be clear about our purpose for having it in the first place.

1. Bonus

Bonuses are paid to recognise a single or combination of outcomes. Typically, they are based on a mixture of individual employee performance and organisational performance.

The purpose of a bonus is usually to:

- Encourage actions or behaviours that will contribute to the success of the organisation.

- Make a reward package more competitive.

Some leaders think an annual bonus will help them retain their people and drive engagement, but this is not usually the case.

If an employee is unhappy in their job, it is unlikely that the prospect of a bonus will help you to retain them. Similarly, many people come to expect their annual bonus, even though it is usually discretionary, not contractual.

If you haven’t communicated bonus metrics and updated people about company performance, suddenly finding out that they won’t receive a bonus at the end of the year can be demotivating.

2. Profit Sharing

The difference between a profit share and a bonus is that this is only paid if the organisation makes a profit. It is usually shared equally between employees, i.e. not based on individual performance.

An organisation may account for some bonus payments in its budget, which means even if it were to make a loss, employees would still receive their bonus.

This approach is not usually hierarchical, like a bonus. The message is that all employees are in this together.

3. Sign-on Bonus

This is a one-off bonus paid to an employee we recruit into our organisation. It’s a way to make our job offer more attractive and encourage the candidate to join.

A sign-on bonus is usually paid to more senior candidates who we want to persuade to join our organisation. They may be eligible for a significant bonus in their present role, or they may have shares/equity and resigning will mean giving these up. A sign-on bonus compensates for these losses.

There is no major research that suggests sign-on bonuses are more or less likely to retain employees. However, if people are attracted to your organisation because you offer a sign-on bonus, chances are they will be attracted elsewhere in a year or two by another one.

4. Recognition Bonus

A recognition bonus is given to employees who go above and beyond to demonstrate results or behaviours that are aligned with your organisational values. This may be working hard on the delivery of a project or delivering outstanding customer service to a client.

Recognition bonuses are discretionary and unexpected, therefore it is the outcome, not the driver for the effort or behaviours.

In order to be effective and encourage the same behaviours, they need to be timely. Recognising someone six months after they delivered outstanding customer service to a client won’t reinforce or communicate why the person is being recognised.

5. Retention Bonus

This form of variable pay is based on the premise that if someone stays with the organisation for a certain period of time, e.g. two to three years, they will receive an annual retention bonus. If they leave before the end of the term, they will lose out. The bonus must be significant enough to encourage someone to stay with the organisation.

A retention bonus can also be a way for managers to offer a higher reward package to someone in their team if:

- This is not possible through the salary increase budget

- A significant salary increase would cause internal equity concerns

The downside is that people who are better at negotiating pay are usually the ones to end up on a retention plan. As a result, we would always suggest running an analysis by gender. Typically, the majority of people on retention plan are male.

6. Sales Incentives

Devised specifically for sales and revenue-generating teams, sales incentives or commission plans are designed to drive certain types of desirable behaviours. They are different from bonuses in a few ways:

- They usually have a much greater focus on individual performance.

- They tend to be more formulaic, with specific targets and measures, compared to a discretionary bonus plan.

- They are often higher payments than bonuses, as sales roles typically have higher variable pay linked to revenue generated by the employee, team or organisation.

Incentive programmes can be monetary or non-monetary but the key is to make sure that they are simple and attainable, and set up in a way that’s easy for everybody to understand.

Reward Your Employees

Variable pay could be a great addition to your pay structure. Incentives like bonuses and profit shares can motivate employees, boost productivity, support recruitment, and retain talent when used in the right way.

However, each method should be consistent and meaningful—used in conjunction with a fair and transparent approach to pay and reward. Without that first step, employees are less likely to engage with their rewards.

For more information on how to implement variable pay in your business, or how to start your journey to pay transparency, book a call with our expert reward team.